Ask anyone and Tax planning will be named as one of the most dreaded things in life. A little miscalculation or leaving a column could make you suffer for your money. Not to forget the new provisions of the Tax Cuts and Job Acts (TCJA) 2017. We can now easily say that Accurate Tax planning and filing is the key to preserving your business in the coming years. However, many American taxpayers are most confused at the hours of filing especially when their tax preparers have not disclosed much of the nuances and exceptions. At Affordable Accounting Solutions, we understand that navigating the law is a complex process with full of ambiguity. However, proactive tax planning can be your key to success. While some may say that it’s wise to wait until complete guidance is presented, most tax professionals would advise the taxpayers that “the sooner, the better.” Here in this article, we explain why it is essential that taxpayers are proactive when it comes to tax planning. If you know us at all, you know we are passionate advocates of proactive tax planning.

Attesting The Deductions

At First we will start with deductions because if you’ve been primarily taking advantage of certain deductions year after year, it will be now more crucial dig deep into your tax situation this year. Many of these deductions could no longer be an option for you. So plan in advance.

Impacted by TCJA

We have now witnessed it more or less that business owners are deeply impacted by the new provisions of the TCJA. It’s likely that your tax situation has grown much more convoluted than it was before. More importantly those individuals who’ve had complex tax returns in the last few years need to meet with their tax professionals. Just make sure that you don’t throw yourself into a nasty surprise in April 2019 with changes in tax deductions and eliminations.Multiple Tax Changes

We will time and again ask you to schedule your meeting with a tax pro from Affordable Accounting Solutions as you may be wondering about the tax changes. There have been multiple revisions in the tax law and these are sure to affect much number of people and businesses in ways it was not deliberated before.The Pass-Through Deduction

The pass-through deduction in the TCJA constitutes a deduction of up to 20% of income from partnerships, sole proprietorship's, and S-corporations. It is especially critical because large number of businesses in the US are pass-through entities. This is one important aspect where business owners and tax preparers need to be watchful.The State and Local Tax (SALT) Deduction

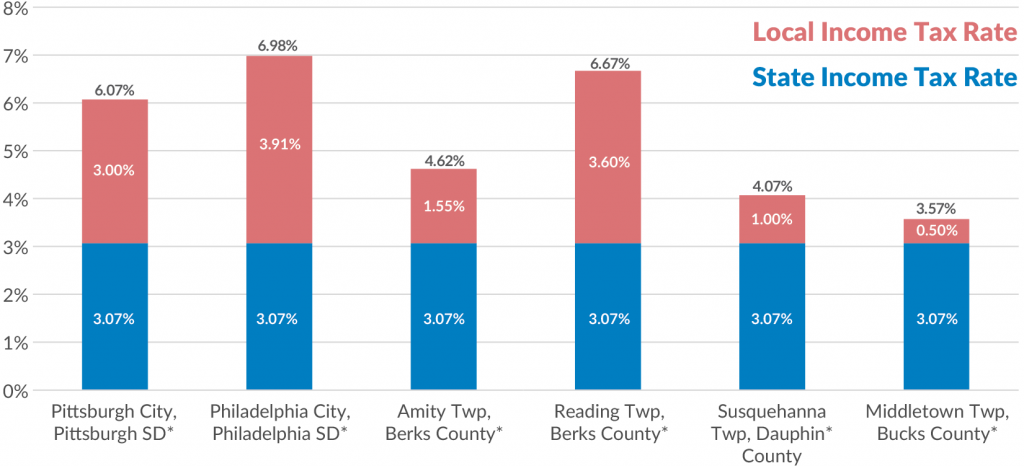

The next deduction impacted by the TCJA of 2017 is the SALT deduction. As per the new laws a limit on the amount is placed for state and local taxes taxpayers. This states that taxpayers can deduct state and local taxes from their federal taxable income up to $10,000.

Moreover there are modifications in a long-standing status quo and the dilemma surrounding prepayment of property taxes along with the deductions of charitable donations and whether or not these practices will be utterly forbidden.

The next deduction impacted by the TCJA of 2017 is the SALT deduction. As per the new laws a limit on the amount is placed for state and local taxes taxpayers. This states that taxpayers can deduct state and local taxes from their federal taxable income up to $10,000.

Moreover there are modifications in a long-standing status quo and the dilemma surrounding prepayment of property taxes along with the deductions of charitable donations and whether or not these practices will be utterly forbidden.

Recent Comments